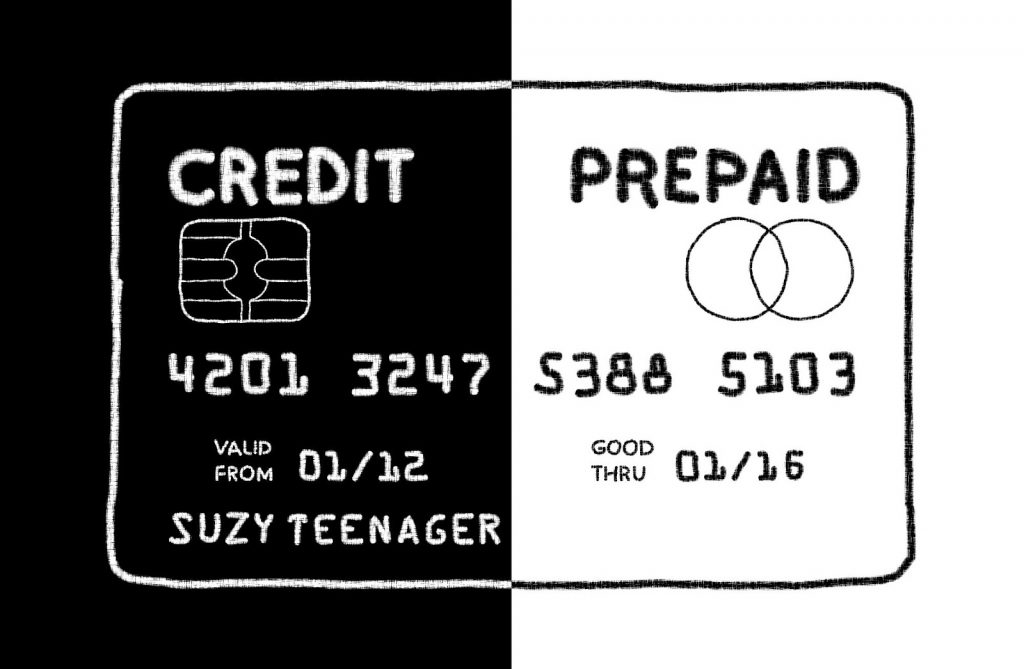

If you are having difficulty with your credit score and rating, or having a hard time getting a credit card you might want to consider a pre-paid card. Nowadays it is virtually impossible to purchase anything without a credit card. Lenders today are offering Pre-Paid Visa and Master Cards, which work like credit cards.

The procedure works like put money into an account and then you are able to use the cards like a regular credit card. No one will know the difference. Prepaid credit cards can be purchased at many stores or online. The downside is you have to pay a small fee when you open an account.

You want to be careful with which card you choose since some are expensive. After the account is open, you have to pay a small fee every time you make another deposit on your account. The upside about prepaid cards is that it can help repair your credit.

Another advantage is, if your credit is bad then the prepaid may be the only the solution for repairing credit. The best solution is to continue paying your bills and avoid spending money on items you do not really need.

Most people spend a fortune during the course of a decade on various items all to sell them later in a garage sale, or else toss them in the garbage when they realize they did not need it in the first place. It pays to consider all aspects of any decision made to avoid complications. Bad credit is an obstacle and in order to defeat the obstacle you have to take steps to resolve the issues.

If you’re looking for prepaid business credit cards to build your business credit score, consider trying the Wells Fargo Business Secured Credit Card. You can make a much larger security deposit if you wish to obtain a high credit limit (up to $25,000).

You’ll earn a fixed cash back rate per dollar spent, and you’ll also receive bonus points for increased company spending. Of course, the key is to use the card wisely by avoiding spending too close to your credit limit and paying your bill on time each month to build business credit.

The Wells Fargo Business Secured Credit Card also allows you to add up to 10 employee cards and charges no foreign transaction fees. Wells Fargo will review your account’s spending and payment history to see when it’s time to automatically upgrade you to an unsecured version of its business credit card. Unsecured credit cards are great for earning more rewards, obtaining a higher limit, and even initiating a balance transfer.

NetSpend has been around for over 20 years and the NetSpend® Visa® Prepaid Card is one of the most popular options for prepaid debit cards. There is no credit check required to apply for a prepaid card and most cardholders can expect their paycheck at least two days early once they set up direct deposit.

You can now also receive cash back for qualifying purchases and there is no overdraft fee on purchases. Purchase Cushion is a feature that allows NetSpend to cover up to $10 if you happen to spend slightly more than what’s available on your card. The money will later be deducted from your balance the next time you load your card.

NetSpend offers a mobile banking app that you can use to check your account balance and see your transaction history. You can also use this app for mobile check deposits, and you are protected against unauthorized purchases with zero liability protection.

A prepaid debit card is similar to a gift card but provides many extra features and benefits. You can only spend the amount that you loaded onto the card. Prepaid debit cards can be used for in-store shopping, online purchases, and to pay bills. You may even have access to make mobile check deposits and view your transaction history through an app.